I've accumulated a couple of Metro's preferred shares last fall and thought since the investment case is still promising and figures haven't changed dramatically it's still worthwhile to do a quick write-up of the investment idea here.

Metro is a German retail giant who brought the cash & carry business to Europe. They came onto my radar since their market capitalisation is a mere 10% of their sales. Business is divided into three business units which contribute vastly different shares to the overall sales of the group:

Cash & Carry

From the annual report:

"METRO Cash & Carry is a leading international player in selfservice wholesale trade. METRO GROUP’s largest sales line, which lent the company its name, celebrated its 50th anniversary in 2014. In 1964, founder Otto Beisheim opened the first METRO Cash & Carry wholesale store in Mülheim an der Ruhr. Its concept was revolutionary at the time: professional customers could select their own purchases all under one roof, pay for them in cash and take the items with them. Over the decades, METRO Cash & Carry has continually expanded this business model, adding new items and services geared to customer needs and local requirements."

The cash & carry business line with its 766 stores is responsible for roughly 30% of overall sales.

Media-Saturn Group

From the annual report:

"In terms of sales, Media-Saturn is METRO GROUP’s second largest sales line and number one among consumer electronics stores in Europe. Media Markt, Saturn, the online retailer Redcoon and the Russian online shop 003.ru belong to the group of companies. These sales brands carry out business autonomously in the marketplace. The company 24–7 Entertainment, one of Europe’s leading providers of technology for the distribution of digital content, is also part of the sales line. In addition, Media-Saturn holds a stake in Xplace, a technology service provider that is one of the leaders in the European market for interactive customer information, as well as in Flip4New, a leading German platform for purchasing used electronic products."

Real

Contributing some €8.4bn in revenue real is a supermarket chain operating only in Germany. The 300 locations are usually hypermarkets with up to 80,000 SKUs on sale.

Galeria Kaufhof

Galeria Kaufhof is a department stores chain. It was sold last week to the Canadian Hdson's Bay group. It was valued at around €2.8 bn. The 135 department stores generated revenues of €3.1bn in 2014 which wasn't a big chunk of the more than €63bn the metro group boosted last year. Nonetheless the €2.8bn is huge compared to Metro's market capitalization of only €7.3bn (measured by the preferred stock's price).

Key Figures & Valuation

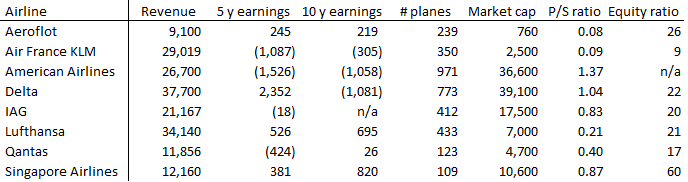

Let's start with a quick run-down of some key figures:

As it seems we had a quite good business up until 2011 when net profit was around €800 million for several years. More recently profits deteriorated. 2013 was marked as a transitional year and accounting was changed from 1st January - 31st December to 1st October - 30th September. So that year in the above table is missing the crucial Christmas business and hence is deeply red. Dividend payment was suspended and the stock tanked as the long term chart shows:

Source: www.onvista.de

The above chart compares the non voting preferred shares with the common shares. Interestingly the preferred shares have lost much more in the past 10 years and trade with a discount of almost 25%. Since there is hardly a take over scenario I suspect the only reason for this discrepancy is the fat, that there is much more attention for the common share due to its membership in the German index MDAX. Trading volume for the preferred stock on the other hand is very low.

At just shy of 23€ per preferred share you can buy Metro at a valuation of around €6.5bn. That's roughly 10% of overall sales. Considering the valuation of their recently sold department stores (around 100% of sales) this seems to be a rather cheap price tag,

Why is the stock so cheap? Several reasons play a role: First of all retail hasn't offered attractive profit margins for quite some time now and this is not likely to change very soon. Media-Saturn weren't exactly the first to discover the internet as an important revenue stream. Metro dropped out of the main German index DAX in 2012 due to the stock's poor performance. That same year Olaf Koch was appointed as new CEO. With 41 years of age he is one of the youngest CEOs among Germany's top companies and has yet to prove that he can bring the company back on track. Events in Ukraine and the Russian crisis weighted heavily on the stock as well since Metro had ambitious plans to sell their Russian activities before the conflict started. These are minor in terms of revenue but the topic certainly didn't help turning around the sentiment for the stock.

Why do I think the stock is a buy?

This is an attractive contrarian bet on a solid company with the extra perk of a heavily discounted preferred stock. I've entered this position at €20 last fall but still think (especially after the recent transaction) that this is a very good risk/reward ratio.

Metro is a German retail giant who brought the cash & carry business to Europe. They came onto my radar since their market capitalisation is a mere 10% of their sales. Business is divided into three business units which contribute vastly different shares to the overall sales of the group:

Cash & Carry

From the annual report:

"METRO Cash & Carry is a leading international player in selfservice wholesale trade. METRO GROUP’s largest sales line, which lent the company its name, celebrated its 50th anniversary in 2014. In 1964, founder Otto Beisheim opened the first METRO Cash & Carry wholesale store in Mülheim an der Ruhr. Its concept was revolutionary at the time: professional customers could select their own purchases all under one roof, pay for them in cash and take the items with them. Over the decades, METRO Cash & Carry has continually expanded this business model, adding new items and services geared to customer needs and local requirements."

The cash & carry business line with its 766 stores is responsible for roughly 30% of overall sales.

Media-Saturn Group

From the annual report:

"In terms of sales, Media-Saturn is METRO GROUP’s second largest sales line and number one among consumer electronics stores in Europe. Media Markt, Saturn, the online retailer Redcoon and the Russian online shop 003.ru belong to the group of companies. These sales brands carry out business autonomously in the marketplace. The company 24–7 Entertainment, one of Europe’s leading providers of technology for the distribution of digital content, is also part of the sales line. In addition, Media-Saturn holds a stake in Xplace, a technology service provider that is one of the leaders in the European market for interactive customer information, as well as in Flip4New, a leading German platform for purchasing used electronic products."

Real

Contributing some €8.4bn in revenue real is a supermarket chain operating only in Germany. The 300 locations are usually hypermarkets with up to 80,000 SKUs on sale.

Galeria Kaufhof

Galeria Kaufhof is a department stores chain. It was sold last week to the Canadian Hdson's Bay group. It was valued at around €2.8 bn. The 135 department stores generated revenues of €3.1bn in 2014 which wasn't a big chunk of the more than €63bn the metro group boosted last year. Nonetheless the €2.8bn is huge compared to Metro's market capitalization of only €7.3bn (measured by the preferred stock's price).

Key Figures & Valuation

Let's start with a quick run-down of some key figures:

As it seems we had a quite good business up until 2011 when net profit was around €800 million for several years. More recently profits deteriorated. 2013 was marked as a transitional year and accounting was changed from 1st January - 31st December to 1st October - 30th September. So that year in the above table is missing the crucial Christmas business and hence is deeply red. Dividend payment was suspended and the stock tanked as the long term chart shows:

Source: www.onvista.de

The above chart compares the non voting preferred shares with the common shares. Interestingly the preferred shares have lost much more in the past 10 years and trade with a discount of almost 25%. Since there is hardly a take over scenario I suspect the only reason for this discrepancy is the fat, that there is much more attention for the common share due to its membership in the German index MDAX. Trading volume for the preferred stock on the other hand is very low.

At just shy of 23€ per preferred share you can buy Metro at a valuation of around €6.5bn. That's roughly 10% of overall sales. Considering the valuation of their recently sold department stores (around 100% of sales) this seems to be a rather cheap price tag,

Why is the stock so cheap? Several reasons play a role: First of all retail hasn't offered attractive profit margins for quite some time now and this is not likely to change very soon. Media-Saturn weren't exactly the first to discover the internet as an important revenue stream. Metro dropped out of the main German index DAX in 2012 due to the stock's poor performance. That same year Olaf Koch was appointed as new CEO. With 41 years of age he is one of the youngest CEOs among Germany's top companies and has yet to prove that he can bring the company back on track. Events in Ukraine and the Russian crisis weighted heavily on the stock as well since Metro had ambitious plans to sell their Russian activities before the conflict started. These are minor in terms of revenue but the topic certainly didn't help turning around the sentiment for the stock.

Why do I think the stock is a buy?

- The stock has an upside potential of 30% to the common stock. There is no reason for this discount and I think time is on my side here.

- Metro traditionally paid a dividend north of 1€ and this makes for a good (and rare) 5% dividend yield. 60% of common stock are with institutional investors who are usually interested in a stable dividend.

- Metro had some €10bn in Real Estate in their books before the Kaufhof transaction. This will now be around €8bn. Although the group is heavily indebted (20% equity ratio is not unusual for retailers) this is a cushion many competitors don't have.

- The cash & carry business and the Media-Saturn Group are market leaders in their industries and will most likely be able to return to decent profit margins at some point in the next couple of years

- All the bad news are already factored into the stock price. Buying a retailer with very strong brands and market position and a solid real estate portfolio for 10% of revenue doesn't sound like a bad deal at all. Tesco for instance with all their recent problems trades at 28.4% of revenues. Walmart almost trades at 50% of total sales.

This is an attractive contrarian bet on a solid company with the extra perk of a heavily discounted preferred stock. I've entered this position at €20 last fall but still think (especially after the recent transaction) that this is a very good risk/reward ratio.