After discussing Gazprom some four weeks ago I'll be looking at Aeroflot today. It is another deeply discounted Russian stock with very promising long term risk/reward ratio. Aeroflot is the poster airline of Russia and has come onto investor's radars last year when Jim Rodgers mentioned the stock as one of his top picks for the Russian market. Let's have a quick look at the long term chart:

So what happened in 2014 to bring down their stock by more than 3/4?

Especially the last point is worrying as the fx situation can carry on for a long time or get even worse. Aeroflot makes more than half of their revenue on foreign routes and these will certainly be able to be repriced accordingly. However, it seems obvious that repricing domestic flights will lead to less travelers. Overall air travel in a country like Russia is certainly more volatile and dependent on economic development than in OECD countries. Lower oil prices should help but are settled in US$ which, at the current fx rates, doesn't really help lower cost for the domestic flights. These issues are certainly serious and have put an awful lot of pressure on the stock.

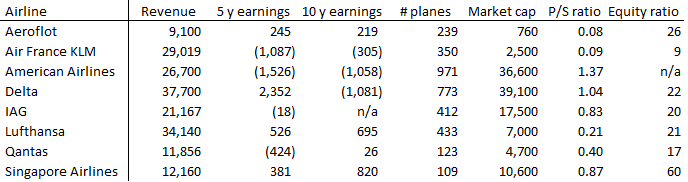

On the other hand you have to look at odds when investing. So in case Aeroflot is still around in a couple of years what will the business be worth? I've worked out an overview of some carriers and their current valuations:

5 and 10 years earnings are averages of the according periods, revenue is 2013's, all numbers in US$. I haven't even tried to calculate P/E ratios as there are so many loosing years. Only other carrier trading at less than 10% of their overall sales is Air France KLM which lost 5 billion dollar in the past 5 years, chapeau! Interestingly Aeroflot sports a higher equity ratio than all the other carriers apart from Singapore Airlines who are apparently very conservatively managed.

In a scenario where the fx situation normalizes and Russia makes a soft landing form the current crisis I reckon a valuation similar to pre-crisis levels is absolutely reasonable, in the long run easily more as air travel in Russia and the former Soviet states is expected to grow above industry growth. That would mean a stock price of 10 Euro or more compared to 3 Euro today. At 10 Euro Aeroflot would trade at a P/E ratio of around 11 when considering the earning power of the last 5 years. Another scenario is obviously a prolonged crisis and a very adverse business environment for Aeroflot. They managed the financial crisis quite well and have been profitable for at least 14 years in an extremely competitive industry so even if the situation around Russia gets a lot worse I don't really see them going belly up but there are substantial risks involved to say the least.

Overall however I think this is a buy. An opinion shared by Aeroflot's CEO Vitaly Saveliev who increased his stake in the company in December. Considering their very young fleet and extremely strong position in their market (manifested by solid profits for more than a decade) I will disregard my aversion for the air travel industry and pick up some stocks on weak days at around 2.75 Euro.

As with any investment ideas, do your own research and never buy anything because someone else thinks it's a great idea.

We had an impressive development from the early 2000s up until the financial crisis catapulting the stock price from well under 2 Euro up to 15. In a year's time the stock then lost all the gains from the previous years. It was trading close to 10 again in February last year before it started yet another dramatic decline down to 2.10. Before we look at what made that happen, apart from the obvious fact that Aeroflot is pretty much a bet on the Russian economy, let's get a quick overview of the company's financials over the last ten years:

Revenue, apart from the 2009 drop, rose steadily. Bottom line was positive all the time which is unusual to say the least for the industry and peaked in '07 and '11. Current market cap (at around 3 Euro per share) is $760 MM. You read that right, that's 8% of 2013's revenue for a company that operated profitable for the past 10 years at a net margin of close to 5% on average.

Why is Aeroflot successful in an industry that is known for loosing tons of money? The reason is Aeroflot has a somewhat monopolistic position in it's home market. Market share of domestic flights is 36%, on all air (domestic + foreign) travel 30%. Aeroflot's biggest shareholder is the Russian state (51%) which is obviously not at all interested in allowing too much competition for it's strategic businesses. I'd call that a moat in Buffet's sense that's unlikely to disappear all that soon. The first low cost carrier entered the market in late 2014 which has eroded margins in other parts of the world. In Aeroflot's case however this is rather regarded as a chance to service even more travelers than a threat as the new carrier was founded by themselves. This carrier will be operating from another Moscow airport (also serviced by Lufthansa for instance) to minimize cannibalization effects.

Those who think of Soviet style Tupolevs when they hear of Aeroflot will be surprised to hear that the Russians actually operate the youngest fleet (all Boeing and Airbus) of all carriers with 100+ jets in operation. And the margin is not thin as illustrated here (average fleet age in years):

|

| Source |

So what happened in 2014 to bring down their stock by more than 3/4?

- 12 month figures are yet to be announced (2. Mar) but 9M figures were red (less than $1 MM loss though!)

- This was partly due to a sharp drop in air travel to and from Ukraine

- With the massive Ruble drop revenue measured in US$ was cut in half!

- All the aircraft are leased on contracts in US$

Especially the last point is worrying as the fx situation can carry on for a long time or get even worse. Aeroflot makes more than half of their revenue on foreign routes and these will certainly be able to be repriced accordingly. However, it seems obvious that repricing domestic flights will lead to less travelers. Overall air travel in a country like Russia is certainly more volatile and dependent on economic development than in OECD countries. Lower oil prices should help but are settled in US$ which, at the current fx rates, doesn't really help lower cost for the domestic flights. These issues are certainly serious and have put an awful lot of pressure on the stock.

On the other hand you have to look at odds when investing. So in case Aeroflot is still around in a couple of years what will the business be worth? I've worked out an overview of some carriers and their current valuations:

5 and 10 years earnings are averages of the according periods, revenue is 2013's, all numbers in US$. I haven't even tried to calculate P/E ratios as there are so many loosing years. Only other carrier trading at less than 10% of their overall sales is Air France KLM which lost 5 billion dollar in the past 5 years, chapeau! Interestingly Aeroflot sports a higher equity ratio than all the other carriers apart from Singapore Airlines who are apparently very conservatively managed.

In a scenario where the fx situation normalizes and Russia makes a soft landing form the current crisis I reckon a valuation similar to pre-crisis levels is absolutely reasonable, in the long run easily more as air travel in Russia and the former Soviet states is expected to grow above industry growth. That would mean a stock price of 10 Euro or more compared to 3 Euro today. At 10 Euro Aeroflot would trade at a P/E ratio of around 11 when considering the earning power of the last 5 years. Another scenario is obviously a prolonged crisis and a very adverse business environment for Aeroflot. They managed the financial crisis quite well and have been profitable for at least 14 years in an extremely competitive industry so even if the situation around Russia gets a lot worse I don't really see them going belly up but there are substantial risks involved to say the least.

Overall however I think this is a buy. An opinion shared by Aeroflot's CEO Vitaly Saveliev who increased his stake in the company in December. Considering their very young fleet and extremely strong position in their market (manifested by solid profits for more than a decade) I will disregard my aversion for the air travel industry and pick up some stocks on weak days at around 2.75 Euro.

As with any investment ideas, do your own research and never buy anything because someone else thinks it's a great idea.

No comments:

Post a Comment